Property Market Review – March 2020

2020 Budget prioritises relief for struggling businesses

As the COVID-19 pandemic continues to rage, many businesses are struggling to cope financially – but small businesses (those with a rateable value of less than £51,000 per year) are deemed to have been the worst hit.

In his Budget speech, the new Chancellor of the Exchequer, Rishi Sunak, announced a raft of emergency measures to mitigate COVID-19’s impact on the economy, including the abolition of business rates for small retail, leisure and hospitality businesses this year (a tax break worth £1bn). No further business rate reform was announced, although Mr Sunak said that a fundamental review of business rates was to take place in the coming months, with results to be presented in the autumn.

The Chancellor also announced a £10,000 cash grant for small businesses eligible for small business rates relief.

Shopping centre giant could go bust after huge losses

Intu Properties, which owns Lakeside in Essex and the Trafford Centre in Manchester, among many others, has issued a warning that it may go under if it is unable to raise the funds to keep afloat. As the UK’s retail sector continues to suffer, Intu proved to be no exception and posted losses of £2bn in 2019.

With more retailers going into administration and closing stores, the value of Intu’s property portfolio dropped by 22% to £6.6bn and the firm racked up huge debts of £4.5bn.

The firm said that ‘extreme market conditions‘ were making investors unwilling to inject cash into the business. In this, Intu is not alone. Investment in the retail sector plummeted by 80% year-on-year in the first half of 2019, with prohibitively high rents leaving many businesses fearing they will have no option but to vacate their premises when their lease comes up for renewal.

London property boost cut short by COVID-19 outbreak

Prior to the outbreak, the outlook for the London property market was promising, following the Conservatives’ election win in December and renewed certainty on Brexit.

Unfortunately, COVID-19, which appears to have hit London particularly hard, has called a halt to the upward trend, according to USB Asset Management. Travel restrictions are set to result in a drop in overseas investment, while previously interested investors and developers are more likely to hold fire to see how the situation develops.

| In his Budget speech, the new Chancellor of the Exchequer, Rishi Sunak, announced a raft of emergency measures to mitigate COVID-19’s impact on the economy… |

House Prices Headline statistics

| HOUSE PRICE INDEX (JAN 2020)* | 121.3* |

| Average House Price | £231,185 |

| Monthly Change | -1.2% |

| Annual Change | 1.3% |

*(Jan 2015 = 100)

- UK house prices increased by 1.3% in the year to January 2020, down from 1.7% in December 2019

- On a non-seasonally adjusted basis, average house prices in the UK decreased by 1.1% between December 2019 and January 2020

- This is compared with a fall of 0.6% during the same period a year earlier

House Prices Price change by region

| Region | Monthly Change (%) | Annual Change (%) | Average Price (£) | |

|---|---|---|---|---|

| England | -1.2 | 1.1 | £247,355 | |

| Northern Ireland (Quarter 4 – 2019) |

0.2 | 2.5 | £140,190 | |

| Scotland | 0.6 | 1.6 | £152,121 | |

| Wales | -2.9 | 2.0 | £161,719 | |

| East Midlands | -0.4 | 2.3 | £195,707 | |

| East of England | -2.2 | -0.6 | £286,999 | |

| London | -1.1 | 1.4 | £476,588 | |

| North East | -2.6 | 0.9 | £126,592 | |

| North West | -1.5 | 2.1 | £164,769 | |

| South East | -1.2 | -0.5 | £320,700 | |

| South West | -1.8 | -0.1 | £254,320 | |

| West Midlands Region | 0.4 | 2.6 | £200,628 | |

| Yorkshire & The Humber | -0.9 | 3.1 | £165,383 |

| Source: The Land Registry Release date: 25/03/2020 Next date release: 22/04/2020 |

AVERAGE MONTHLY PRICE BY PROPERTY TYPE – JAN 2020

| PROPERTY TYPE | ANNUAL INCREASE |

|---|---|

| DETACHED £347,990 |

-0.30% |

| SEMI-DETACHED £222,604 |

2.90% |

| TERRACED £188,303 |

2.70% |

| FLAT / MAISONETTE £200,721 |

-1.10% |

Source: The Land Registry

Release date: 25/03/2020

| Contains HM Land Registry data © Crown copyright and database right 2017. This data is licensed under the Open Government Licence v3.0. |

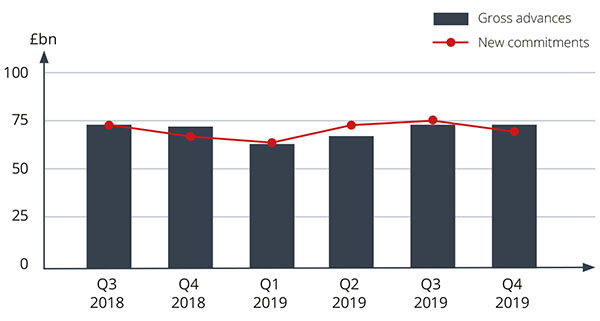

Mortgage Activity

- The value of gross mortgage advances was £73.4 bn in 2019 Q4

- This is broadly unchanged in comparison to 2018 Q4

Source: FCA & Bank of England

It is important to take professional advice before making any decision relating to your personal finances. Information within this document is based on our current understanding and can be subject to change without notice and the accuracy and completeness of the information cannot be guaranteed. It does not provide individual tailored investment advice and is for guidance only. Some rules may vary in different parts of the UK. We cannot assume legal liability for any errors or omissions it might contain. Levels and bases of, and reliefs from, taxation are those currently applying or proposed and are subject to change; their value depends on the individual circumstances of the investor. No part of this document may be reproduced in any manner without prior permission.

@media only screen and (max-width: 768px) {

.single-post__content .mobile-hide {width: 100%!important; margin: 0 0 20px 0!important; display: block!important;}

}

.back-to-top {margin: 20px 0 40px 0; background-color: #eaeaea; color: #666; display: inline-block; padding: 10px; text-decoration: none; border-radius: 3px; border: solid 1px #aaa;}

.back-to-top:hover {margin: 20px 0 40px 0; background-color: #999; color: #fff;}