Property Market Review February 2019

CONTRADICTORY DATA FROM COMMERCIAL PROPERTY SURVEYRespondents to the latest Royal Institute of Chartered Surveyors (RICS) ‘UK Commercial Property Market Survey’ have blamed political uncertainty for the disparate performance of the three major sectors of the commercial property market – industrial, retail and office – as Q4 2018 saw all-sector occupier demand falling for the third consecutive quarter to -13% compared with the previous figure of -9%. A large proportion of this decline can be laid at the door of the retail sector, with a sharp fall in tenant demand, which reported a net balance of -58%. In addition, there was a decline in demand for office space at -9%. In contrast, the industrial sector saw a far more positive result of +21% of respondents noting an increase over the period. In terms of the investment market, investment enquiries (in net balance terms) in the retail sector, also declined at their highest quarterly rate, whilst industrial assets saw a rise in investor interest. SHARED OFFICE SPACE PROPERTY VALUES SOARA recent report from real estate lawyers, Boodle Hatfield, reveals that the top ten shared office providers saw their property values rise by 35%, to a total of £13.6bn in 2018. The data also shows growth in demand for shorter leases from major companies. To put that into perspective; 1987 saw the average new commercial property lease duration of 25 years, whereas in 2017, that lease period had been reduced to 7.1 years on average. The report went on to add that there appeared to be increased demand from established property investment companies, such as Great Portland Estates, Landsec and British Land, to investigate this sector for opportunities. Simon Williams, a Partner at Boodle Hatfield, commented: “Shared workspaces have now gone beyond being a cool place for media and tech start-ups – they are now a substantial part of the commercial property market in major cities worldwide.”

SCOTTISH COMMERCIAL PROPERTY SECTOR HAS A GOOD YEAREstate agency, Knight Frank, reported a total of £2.5bn invested in the Scottish commercial property market in 2018. This figure exceeded the annual £2.46bn average seen since 2014. They went on to add that UK funds increased their investment in the sector by more than 58% during the year, to a total of £771 million, compared with last year’s £487 million. Overseas investors in Scotland, accounted for £920 million, which represented 36.8% of the overall figure. Whilst the retail sector saw a decline in investment by £115 million, office space thrived, with £1bn invested across the country, with Glasgow, Aberdeen, and Edinburgh accounting for £897 million of this. ‘CRANE INDEX’ POINTS THE WAY TO HIGH CONFIDENCE IN CITY DEVELOPMENTDeloitte has revealed, in its crane survey, that property developers sustained new activity during 2018, right across the regions of the UK. The survey shows that there were 34 schemes under construction in Belfast city centre, with 21 schemes completed in 2018 and nine set for completion this year. The report confirms it was a healthy year for office development in Belfast, as work began on over 400,000 sq. ft. of office space, making good progress against the Belfast Agenda target of 1.5 million sq. ft. by 2021. Birmingham boasted 23 new sites developed, and Leeds saw its largest development total since 2002 – when the survey began – as 21 new sites were developed; including seven office projects that will deliver a total of 844,986 square feet of space. |

| Back to top |

HOUSE PRICES HEADLINE STATISTICS |

|||||||||

|

| Back to top |

HOUSE PRICES PRICE CHANGE BY REGION |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| Back to top |

AVERAGE MONTHLY PRICE BY PROPERTY TYPE – DEC 2018 |

|||||||||||

Source: The Land Registry

|

| Back to top |

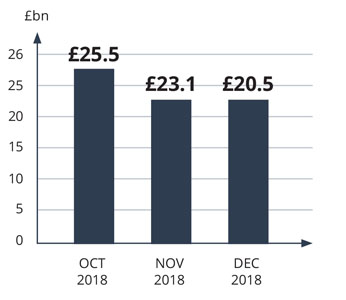

MORTGAGE ACTIVITY |

|

| Back to top |

| It is important to take professional advice before making any decision relating to your personal finances. Information within this document is based on our current understanding and can be subject to change without notice and the accuracy and completeness of the information cannot be guaranteed. It does not provide individual tailored investment advice and is for guidance only. Some rules may vary in different parts of the UK. We cannot assume legal liability for any errors or omissions it might contain. Levels and bases of, and reliefs from, taxation are those currently applying or proposed and are subject to change; their value depends on the individual circumstances of the investor. No part of this document may be reproduced in any manner without prior permission. |